Self-employment can turn a Florida divorce into a numbers problem fast. A W-2 paycheck tells one story. A business bank account, credit card, and “write-offs” can tell another. When support or alimony turns on income, the court must separate real business expenses from personal spending that simply took a detour through the company.

This post explains how Florida defines business income, how “lifestyle” evidence can matter, and when a court may impute income if someone claims they earn less than they reasonably could.

Separate “Business Income” From Personal Spending Dressed as Expenses

Florida child support law counts income from self-employment and closely held businesses, calculating it by taking total revenue and subtracting only expenses that are reasonably necessary to generate that income.

That definition sounds simple, but disputes usually start here. A personal vehicle, travel, meals, or a home office can carry mixed use. The court can look past labels and ask a practical question: Did this expense truly help generate business income, or did it mainly support a personal lifestyle?

Clear records help. So does consistency between tax returns, bookkeeping, and what you list on your financial affidavit.

Use Lifestyle Evidence to Cut Through “Expense Noise”

Lifestyle evidence means proof of how someone lives; things like rent or mortgage payments, vehicles, travel, private school tuition, large purchases, or recurring transfers to savings. It does not replace financial documents. It supports them.

When a self-employed spouse reports low income but keeps spending at a high level, the other side often uses:

- bank and credit card statements (personal and business)

- payment apps and merchant records

- loan applications and financial statements

- business ledgers that show owner draws and reimbursements

This evidence can expose patterns like personal bills paid by the business, unusually high “business” reimbursements, or cash deposits that never show up on a profit-and-loss statement.

Know When Florida Courts May Impute Income

Imputed income means the court assigns an income level based on earning capacity instead of reported earnings. Florida law allows imputation when a parent’s unemployment or underemployment is voluntary, absent incapacity or circumstances beyond the person’s control. The judge can look at work history, qualifications, and local earning levels when setting a number.

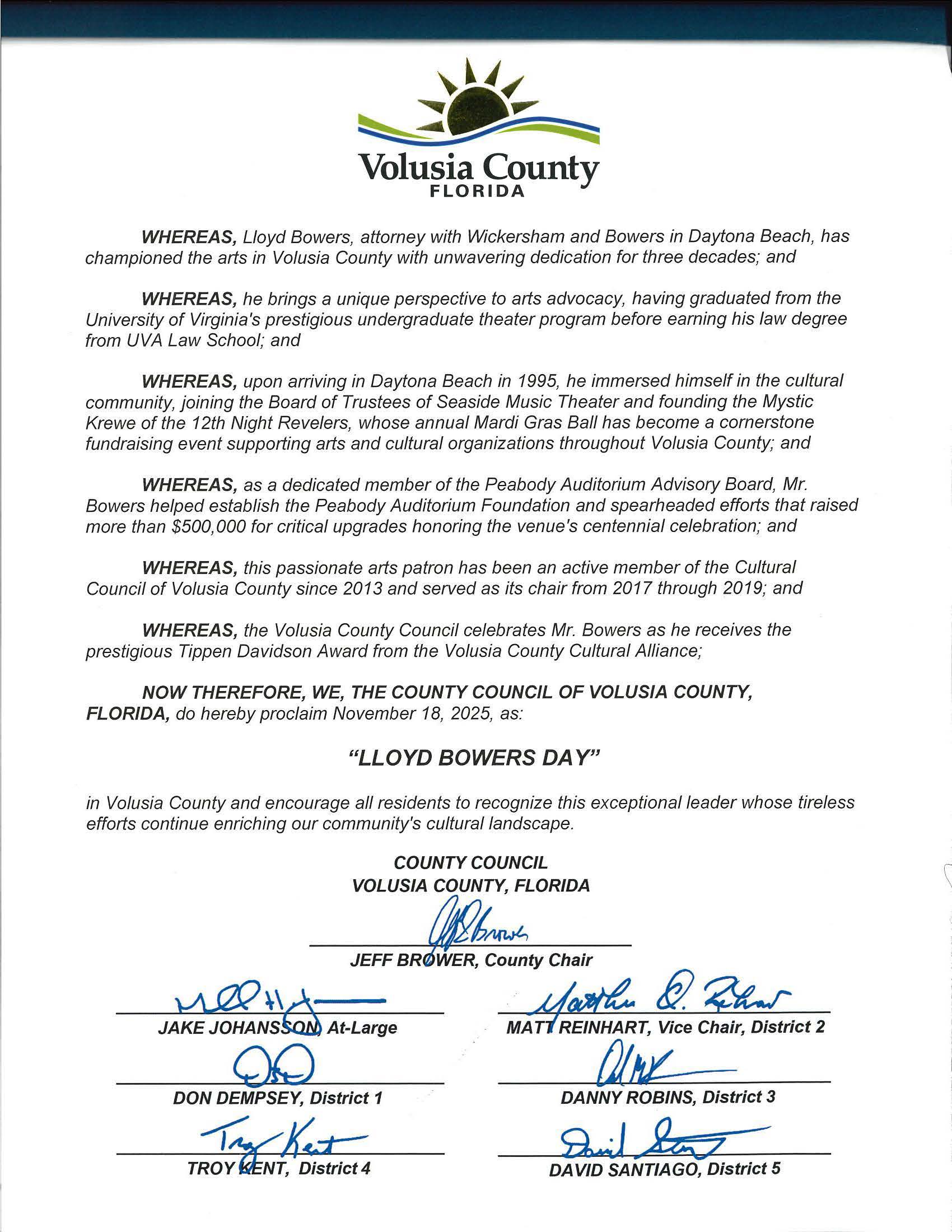

Wickersham & Bowers handles Florida divorce matters involving support, custody, and financial disputes. Call 386-252-3000 or fill out our contact form.